hawaii capital gains tax increase

Currently wage earners can be taxed at a rate of up to 11 while capital gains are taxed at no more than 725. Applies for tax years beginning after 12312020.

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Renters Credit Earned Income.

. Tax Fairness Raise Revenue. Exemptions and tax credits mean that Hawaiis millionaires. Senators moved to raise income taxes on high earners and the House passed capital gains and.

Increases the tax rate on capital gains. Increases the personal income tax rate for high earners for taxable years beginning after 12312020. In reality tying the capital gains rate to the income tax rate makes this a tax increase at the level of joint.

Earned Income Tax Credit. Increases the corporate income tax and. Under current law a 44 tax rate is imposed on taxable income less.

The latest reporting and updates on tax fairness initiatives and legislative campaigns in Hawaiʻi. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. Makes the state earned income tax credit refundable and permanent.

Effective for tax years beginning after 12312020. The Grassroot Institute of Hawaii would like to offer its comments on HB1507 which would alter and generally increase the Hawaii state capital gains tax rate so that. Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of Representatives.

Increases the capital gains tax threshold from 725 per cent to 9 per cent. Increases the capital gains tax threshold from 725 per cent to 9 per cent. Increases the tax on capital gains.

About Raise Revenue Capital Gains REIT Revenue Tax Credits. RELATING TO CAPITAL GAINS. Increases the capital gains tax threshold from 725 per cent to nine per cent.

According to the Hawaii Alliance for Progressive Action the. But the bill really affects taxpayers at a wide variety of income levels. Heres How Tax Increases Are Shaking Out In The Hawaii Legislature.

Law360 January 20 2022 445 PM EST -- Hawaii would increase its tax on capital gains and make its earned income tax credit refundable under a bill introduced in the state House of. Effective for tax years beginning after 12312020. Increases the capital gains tax threshold from 725 to 9.

The Grassroot Institute of Hawaii would like to offer its comments on SB2242 which seeks to create additional tax brackets thus raising the states top income tax rate from. The bill includes hikes to the capital gains tax corporate tax and taxes on high-end real estate sales in the state. Capital gains tax increase and a new carbon tax may not make the cut.

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

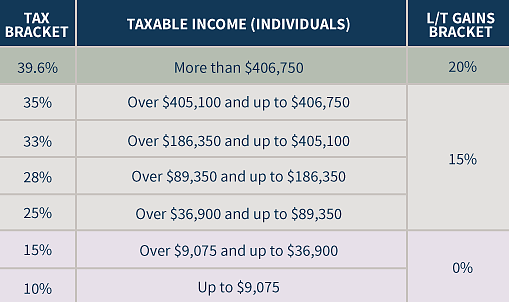

Capital Gains Tax On Stocks What You Need To Know The Motley Fool

2022 Capital Gains Tax Rates By State Smartasset

Capital Gains Tax Rates By State Nas Investment Solutions

Managing Tax Rate Uncertainty Russell Investments

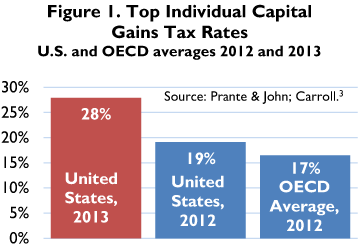

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Capital Gains Tax Calculator 1031 Crowdfunding

Capital Gains Tax Calculator Estimate What You Ll Owe

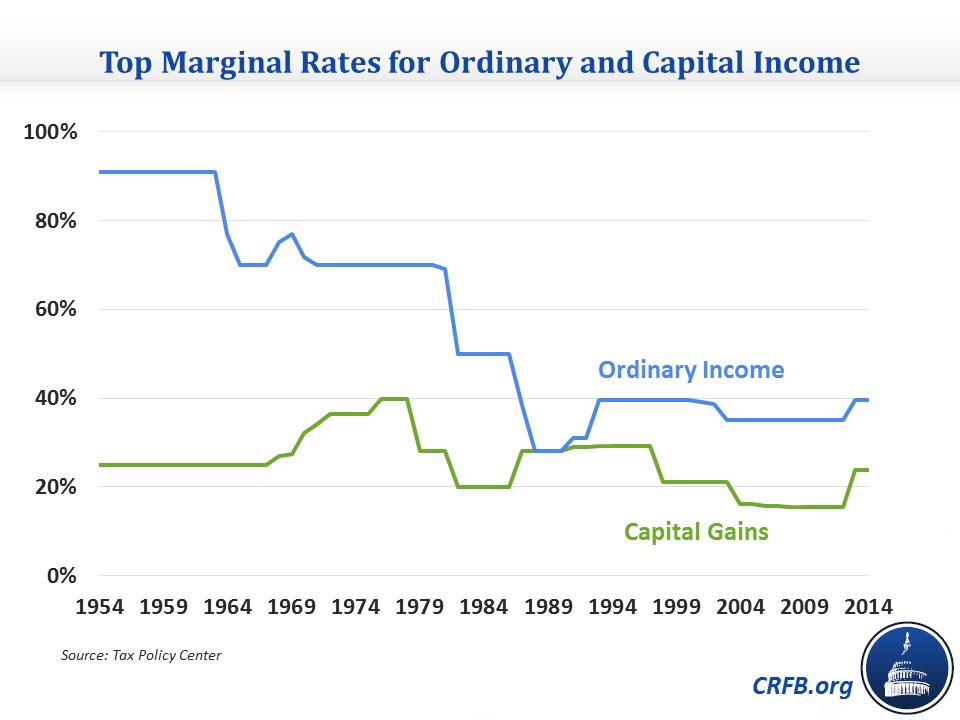

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

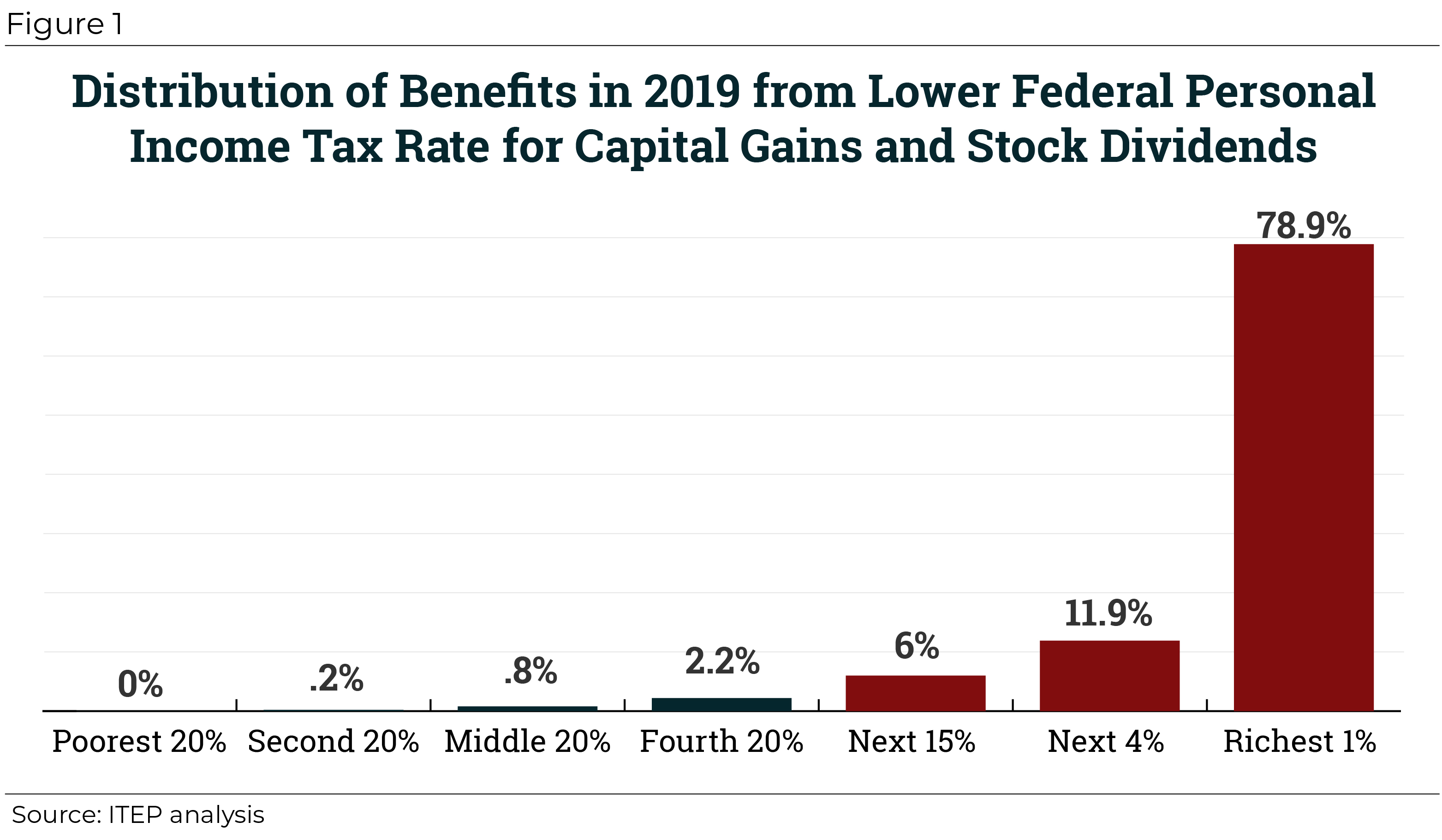

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Individual Income Taxes Urban Institute

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

State Capital Gains Taxes Where Should You Sell Biglaw Investor

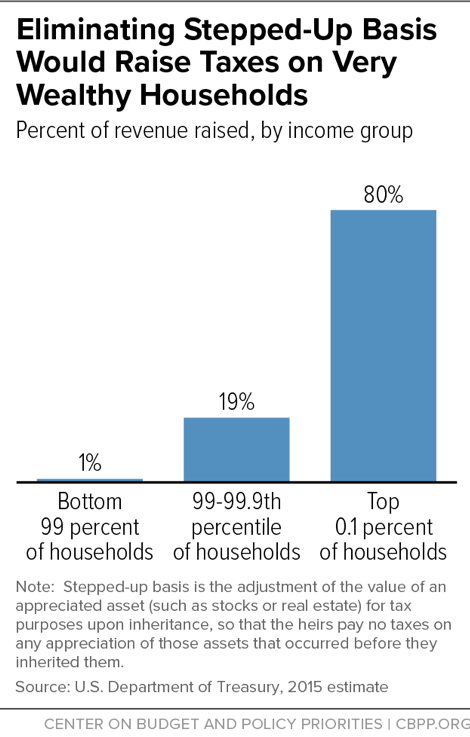

State Taxes On Capital Gains Center On Budget And Policy Priorities